What is a Public Limited Company? If you’re planning to start a big business or want to raise money from the public, …

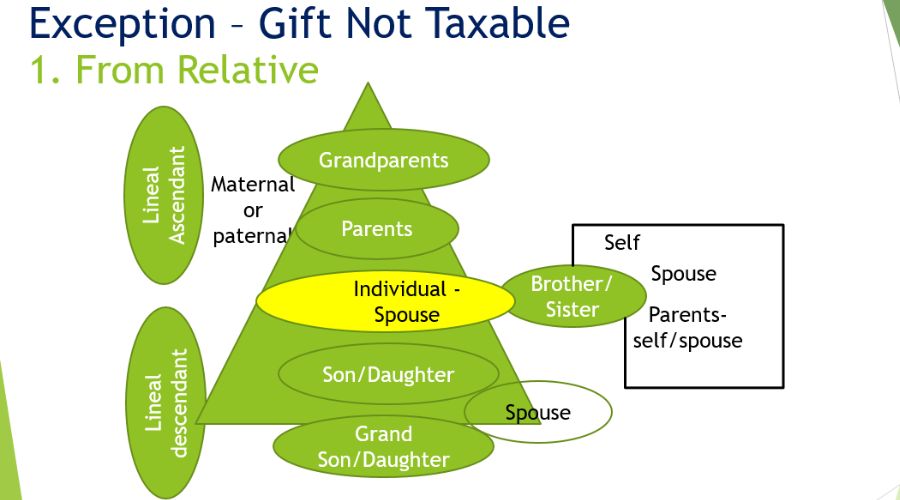

Gift tax in India applies to individuals receiving gifts in cash, property, or specified assets. Understanding the taxation rules on gifts is essential to ensure compliance with the Income Tax Act, 1961. This blog will discuss about Income Tax on Gift provisions related to gift taxation and exemptions.

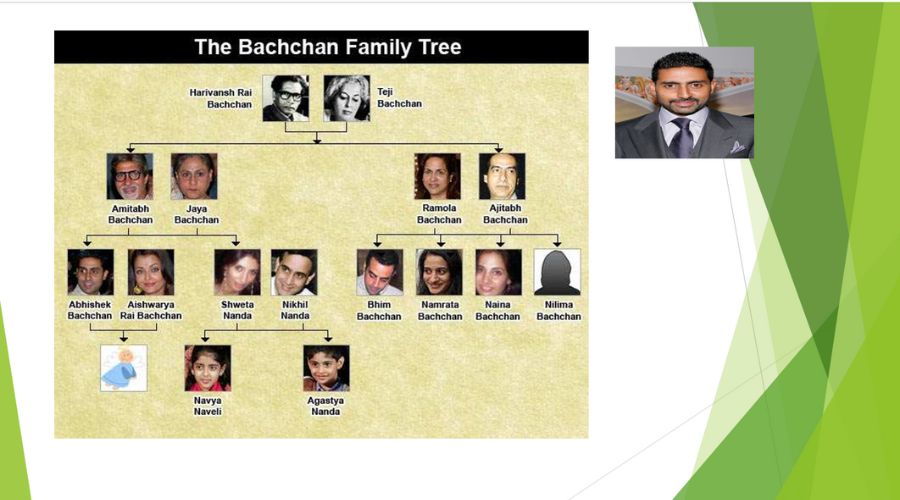

Why Didn’t Hardik Receive Any Gifts at His Wedding? And Why Did KL Rahul Receive So Many Gifts?

What is a Public Limited Company? If you’re planning to start a big business or want to raise money from the public, …

What is A Private Limited Company? If you’re planning to start a business, you’ve probably heard the term “Private Limited Company.” But …

How to Get Money Lending License? Are you planning to start a money lending business in India? If yes, then getting a …

How to Start One Person Company in India? Thinking of starting your own business, but don’t want partners? A One Person Company …

Difference Between Private Limited & Public Limited Company A Private Limited Company is a type of business that’s owned by a small …

Cash

Received without Consideration Aggregate Value > 50K – Taxable whole amount – Aggregate Value

Immovable Property

Without Consideration – Stamp Duty Value > 50K – Taxable (SDV) – Individual Property Wise

Inadequate Consideration – If (Consideration – SDV) > 10% of Consideration AND (Consideration – SDV) > 50K – Taxable (IC) – Individual Property Wise

Property Other Than Immovable Property

Without Consideration – Aggregate FMV > 50K – Taxable (FMV) – Aggregate Value

Inadequate Consideration – Aggregate FMV – Amount paid > 50K – Taxable (IC) – Aggregate Value

Jewelry includes:

Understanding the taxation rules on gifts helps in better financial planning and tax compliance. While gifts received from relatives and on specific occasions are exempt, other gifts exceeding ₹50,000 are taxable. It is crucial to maintain proper documentation to avoid any income tax implications.

E Accountax Manager helps individuals and businesses with tax compliance, including gift tax regulations. Our experts provide clear guidance and seamless filing assistance, ensuring you adhere to the latest tax laws while maximizing tax benefits. Contact us today at E Accountax Manager for hassle-free tax solutions!

CA Jitendra Agarwal, a Chartered Accountant, is an experienced Income Tax Advisor with a proven track record in tax planning and compliance.

Form 10BD and 10BE Explained: Step-by-Step Filing Guide for NGOs Share To ensure transparency and accuracy in reporting donations, the Government of …

GST on Exports in India – A Complete Guide for Exporters Share The government of India implemented the Goods and Services Tax …

What is E-Invoicing System of GST? Share In recent years, the Government has undertaken several digital transformations in the Goods and Services …

GSTR-1/1A Filing Update May 2025: Mandatory Document Reporting of HSN Code in GSTR 1 Share The GST portal has introduced important changes …

Process of GST Registration in India Registering for GST in India is now very simple and fully online. The Ministry of Finance …

How to Register For EPF Online? Share If you want to give your employees the benefits of PF, you need to register …

Who is Eligible for ESI Registration in Rajasthan? Share If you run a business in Rajasthan, you might have heard about ESI …

What is a Public Limited Company? If you’re planning to start a big business or want to raise money from the public, …

What is A Private Limited Company? If you’re planning to start a business, you’ve probably heard the term “Private Limited Company.” But …

How to Get Money Lending License? Are you planning to start a money lending business in India? If yes, then getting a …

[metform form_id=”213″]

We value your privacy.